Financial institutions (FI) and cash-intensive businesses are under increasing pressure to do more with less. Labor costs are rising, regulatory scrutiny is tightening, and the margin for error in cash handling continues to shrink. Manual processes like end-of-day balancing, cash counting, and shift handovers are costly, time-consuming, and prone to error.

Enter the Teller Cash Recycler (TCR): a smart, scalable solution that automates the entire in-branch cash management process. From validating and storing bills to dispensing change on demand, TCRs dramatically reduce workload and risk. They are an essential cash management solution for FI’s and cash-heavy retailers.

In this guide, you’ll learn how TCRs are reshaping branch operations. You’ll also discover how tools like Smart Safe systems, refurbished ATM options, and modular ATM parts fit into a modern cash automation strategy, and why outsourcing ATM services alone isn’t enough for real efficiency.

What Is a Teller Cash Recycler (TCR)?

A Teller Cash Recycler (TCR) is a machine that automates both the depositing and dispensing of cash at the teller line. It validates bills for authenticity, sorts and stores notes securely, and accurately dispenses the correct amount as needed. All in real time.

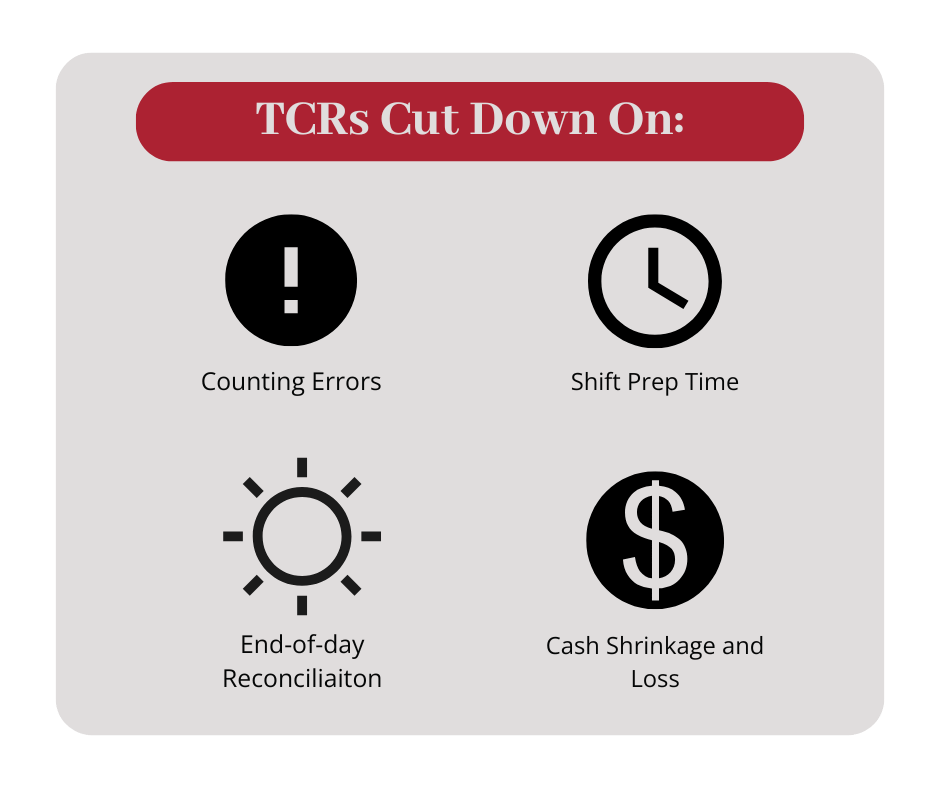

Compared to manual cash handling, TCRs drastically cut down on:

- Counting errors

- Shift prep time

- End-of-day reconciliation

- Cash shrinkage and loss

TCRs offer a two-way solution. They both accept and dispense cash, making them a more complete fit for your business or financial institution.

Why Your Institution Needs a TCR

TCRs are no longer luxury equipment. They’re essential for financial institutions aiming to optimize branch performance and deliver measurable ROI. Here’s why:

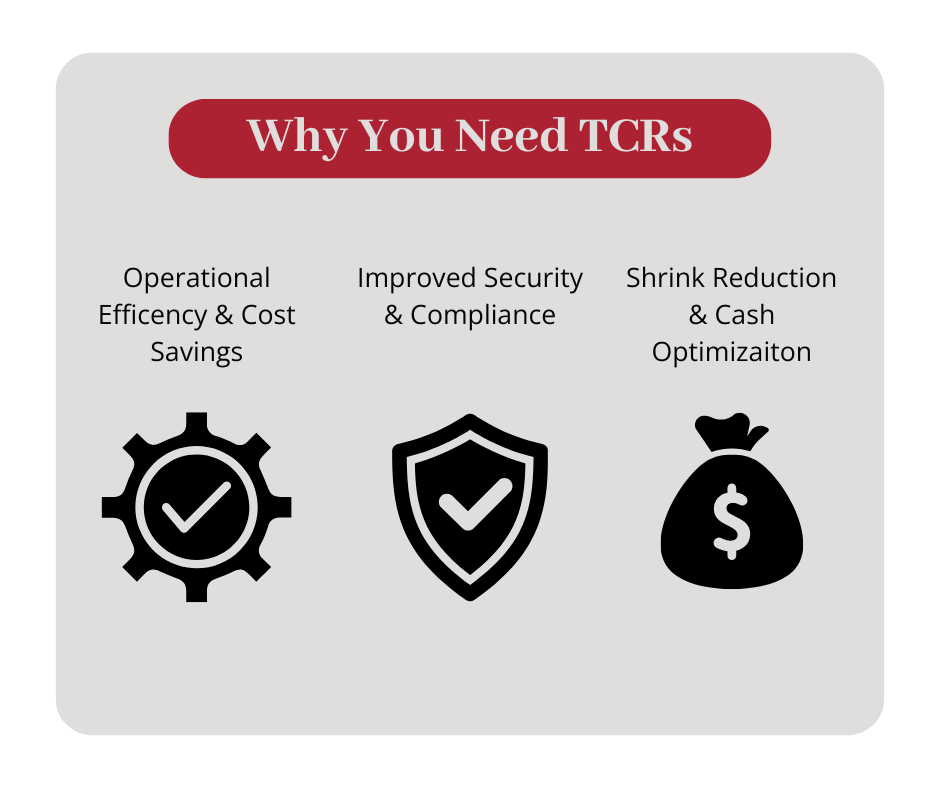

1. Operational Efficiency & Cost Savings

Manual cash handling remains one of the most labor-intensive tasks in any branch. TCRs automate note counting, deposit, and dispensing. They reduce prep time and free up staff for higher-value tasks like customer service or lending.

They also accelerate end-of-day reconciliation, enabling faster branch closing and reducing overtime costs. In many cases, TCRs contribute to fewer FTEs (Full-Time Equivalents) required to run a branch efficiently.

2. Improved Security & Compliance

CIMA TCRs come equipped with bill validation sensors (like the BV5000) and secure cassette or stacking bag options, ensuring that counterfeit detection and cash storage meet the highest compliance standards.

Systems log every transaction, provide real-time exception alerts, and offer complete auditability. They reduce the risk of internal theft and support compliance with financial regulations.

3. Shrink Reduction & Cash Optimization

TCRs allow institutions to lower their cash-on-hand levels by cycling existing cash throughout the day. By reducing idle cash in drawers and safes, organizations experience:

- Lower risk of loss

- Less time managing floats

- Better control over branch liquidity

This optimization of cash inventory directly contributes to faster return on investment (ROI).

TCR Technology: Rolled Storage vs. Cassette-Based

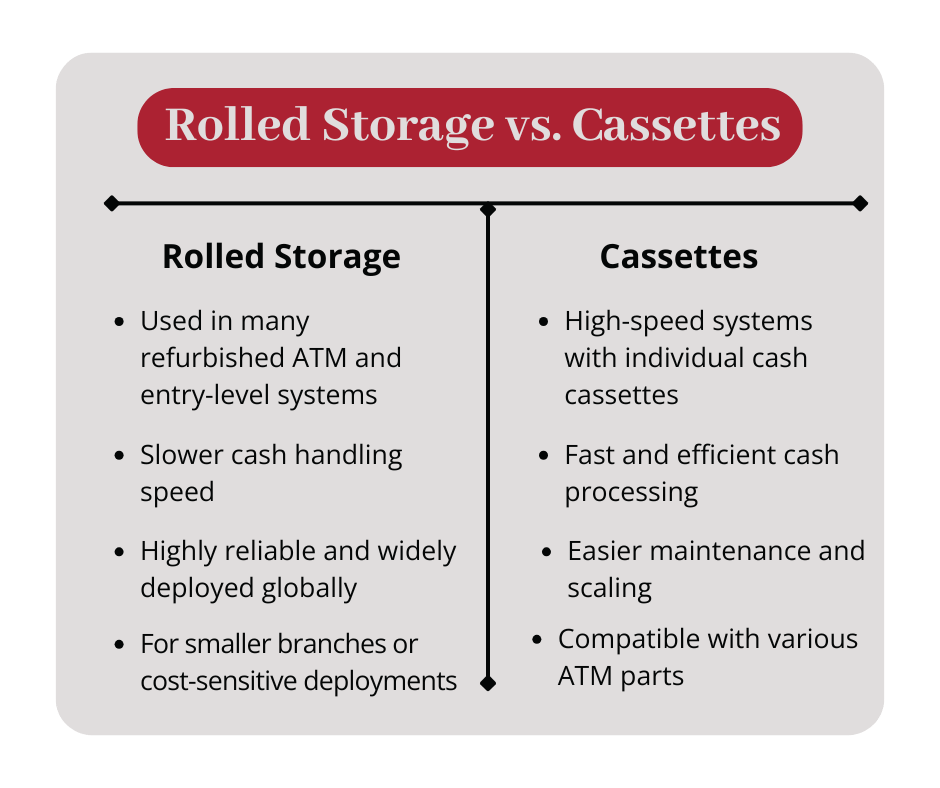

TCRs typically fall into two categories: Rolled Storage or Cassette-Based, each with distinct pros and cons.

Rolled Storage

- Used in many refurbished ATM and entry-level systems

- Slower cash handling speed

- Highly reliable and widely deployed globally

- Ideal for smaller branches or cost-sensitive deployments

Cassette-Based Systems

- Modular, high-speed systems with individual cash cassettes

- Fast and efficient cash processing

- Easier maintenance and scaling

- Preferred in U.S. institutions with high-volume demands

- Compatible with various ATM parts for easy upgrades or replacements

Choosing the Right TCR for Your Branch

Traditional ATM ownership is a capital-intensive endeavor. You’re responsible for purchasing the equipment, handling repairs, replacing ATM parts, and upgrading technology to meet evolving standards. But ATM outsourcing flips this model on its head.

Every financial institution has unique operational needs. Fortunately, TCRs are scalable and configurable to fit branches of all sizes:

- Entry-level models for small branches or low-volume cash environments

- Mid-range options with note-only recycling

- Full-scale systems combining both note and coin recycling, ideal for regional or high-traffic locations

Whether you’re managing one branch or a multi-location network, TCRs provide a modular approach. You can mix coin and note recyclers, select your cassette capacity, or even add secure, self-sealing stacking bags to improve cash transport.

How TCRs Compare to Other Cash Handling Solutions

TCR vs. Smart Safe

A Smart Safe is ideal for one-way deposits, but lacks dispensing capability. TCRs offer both deposit and withdrawal functions, enabling true cash recycling at the teller line. They also support dual control access and real-time monitoring, which most Smart Safes do not.

TCR vs. ATM Outsourcing

Outsourcing ATM services helps institutions provide customers with access to cash. But TCRs serve internal efficiency, streamlining in-branch cash operations and enabling staff to do more with fewer resources. Together, TCRs and outsourced ATMs create a full-stack cash management strategy.

Why Now Is the Time to Automate Cash Handling

Rising wages, tighter compliance demands, and changing customer expectations mean automation is no longer optional. In the current environment, manual cash handling costs your institution more than just money. It costs time, accuracy, and staff satisfaction.

Whether you’re looking to scale up or streamline existing operations, TCRs offer the speed, security, and flexibility your business needs.

Get Expert Help from MVP

MVP offers tailored solutions to help you modernize your cash handling infrastructure. From CIMA TCR deployments and refurbished ATM options to replacement ATM parts and support services, our team delivers:

- Industry expertise

- Cost-effective packages

- Scalable, future-ready cash automation tools

Contact MVP today for a personalized assessment and solution plan for your institution.