In today’s rapidly evolving financial landscape, advanced technology is no longer the exclusive domain of large national financial institutions. While major institutions may dominate with expansive product suites, smaller FI’s – credit unions, community banks, and local providers – are increasingly finding their edge, especially when it comes to fee-based services like smart safes.

With businesses increasingly seeking secure and efficient ways to manage cash, smart safe technology is in high demand. Moving up the value chain to higher volume offerings like Teller Cash Recyclers (TCRs), users can experience familiarity because of common components often found in ATM technology. Supported by accessible parts and skilled technicians, smart safes present a strong opportunity for community-based institutions to strengthen client relationships and grow their service portfolios.

This guide explores how smart safes work, how to use them, and how MVP provides custom-fit, reliable solutions for your needs.

What Is a Smart Safe?

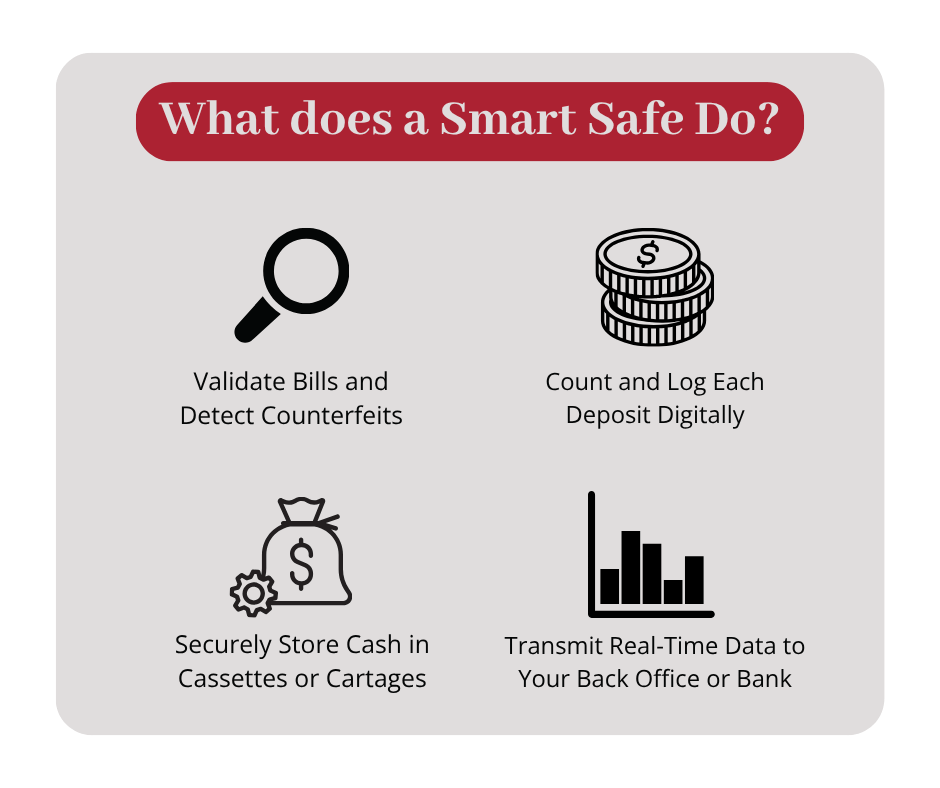

A smart safe is an advanced, secure device that does more than just store cash. Unlike a traditional safe, which simply holds your money, a smart safe can:

- Validate bills to detect counterfeits

- Count and log each deposit digitally

- Securely store cash in cassettes or cartridges

- Transmit real-time data to your back office or bank

Think of it as a mini cash management system. Smart safes use technology to automate and track cash handling, so you always know how much cash is on hand, and you don’t have to rely on manual counting or daily trips to the bank. They reduce human error and provide a strategic entry point for small banks and credit unions to expand their services and deepen business relationships.

Who Needs a Smart Safe?

Though smart safe offerings are often associated with large FI’s, they present a valuable growth opportunity for smaller institutions. Here’s how:

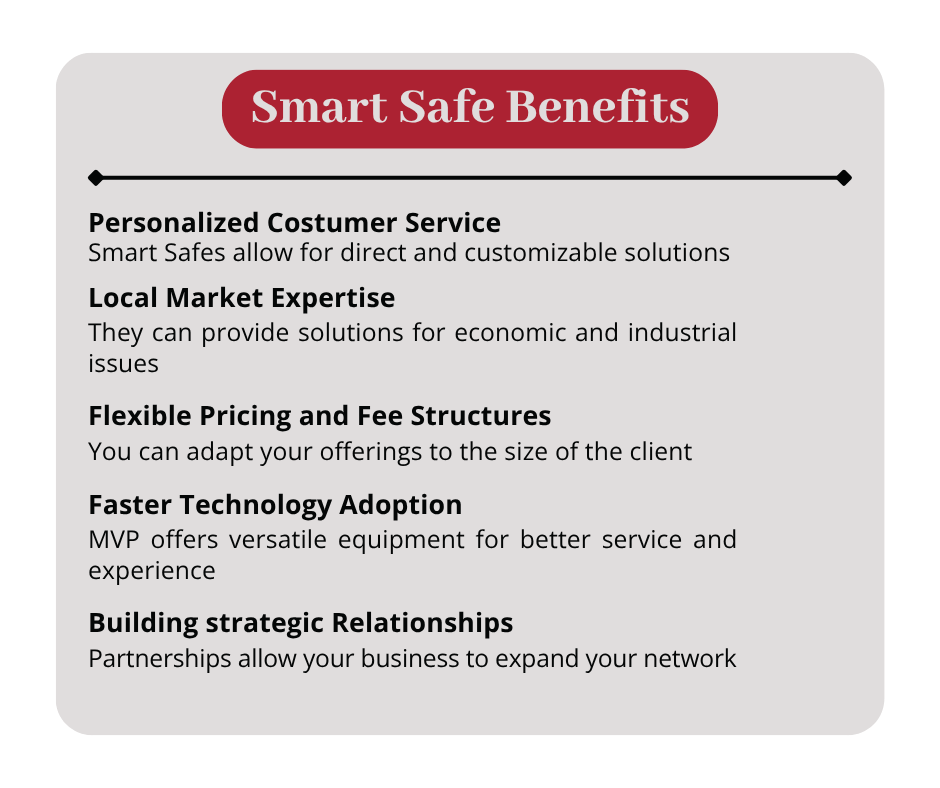

1. Personalized Customer Service

Small FI’s are known for their close-knit relationships with customers – a strength that translates well into fee-based smart safe programs. Unlike larger institutions that typically offer standardized, one-size-fits-all products, small FI’s can:

- Customize smart safe solutions based on business needs

- Provide direct support, reducing reliance on impersonal call centers

- Combine smart safe and ATM offerings into a compelling cash automation solution

This personalized approach is especially valuable for local businesses who may also be managing their own parts, working with TCR/ATM technicians, or looking to streamline their cash-handling infrastructure. Smart safes are especially significant in the cannabis and alternative finance industries where cash is more prevalent.

2. Local Market Expertise

Community financial institutions have deep insight into local economic conditions and industry challenges. That gives them a strategic edge in identifying which businesses could benefit most from smart safes.

For example:

- Businesses small and large are facing local shortages, cash automation fills the gap

- Local retailers facing cash reconciliation issues

- Quick-service restaurants looking for faster end-of-day closeouts

- Dispensaries with added security and compliance needs

By understanding these niche challenges, MVP Financial Equipment crafts highly targeted solutions that larger FI’s may miss entirely.

3. Flexible Pricing and Fee Structures

While big FI’s often have rigid pricing, smaller institutions can adapt their offerings to match the scale of their clients. This flexibility matters to:

- Small retailers with tight margins

- Businesses that fluctuate in cash volume seasonally

- Clients outsourcing cash automation can combine ATM and smart safes because of the commonality of ATM and smart safe needs (armored service, parts, support)

4. Faster Technology Adoption

Despite having more resources, large FI’s can be slower to innovate due to internal red tape or outdated infrastructure. MVP Financial Equipment, on the other hand, offers versatile packages that can:

- Move quickly with new smart safe integrations

- Partner with emerging providers for cutting-edge features

- Adapt their systems to combine ATM parts monitoring and smart safes or real-time ATM/TCR–technician dispatching

This agility allows local providers to compete–and often outperform–larger competitors when it comes to service speed and user experience.

5. Building Strategic Partnerships

Instead of building infrastructure from scratch, MVP Financial Equipment can collaborate with smart safe manufacturers and act as the service providers. This partnership allows your business to:

- Access pre-built networks for TCR/ATM outsourcing and support

- Offer clients expert-level service without in-house technicians

- Leverage shared platforms for seamless deposit tracking and reporting

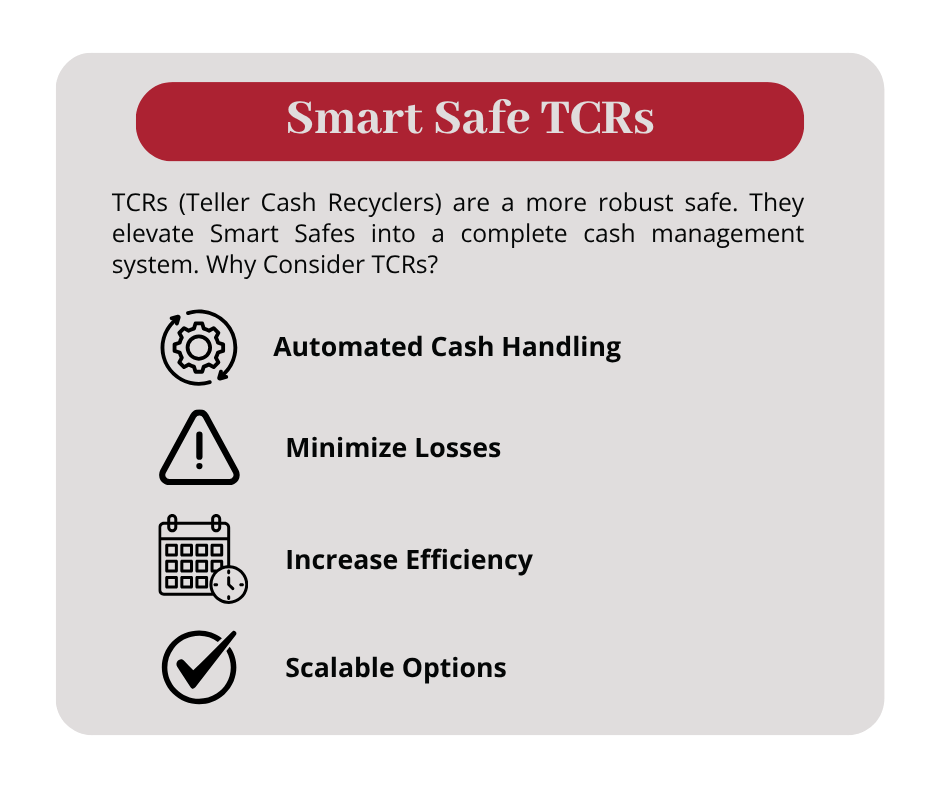

TCRs: A More Robust Smart Safe

TCRs (Teller Cash Recyclers) elevate smart safes into a complete cash management system. While smart safes handle secure deposits, TCRs handle both deposits and dispensing. This creates a more dynamic, all-in-one solution that is ideal for financial institutions with higher cash flow needs.

Why consider a TCR?

- Automated Cash Handling: Accepts, authenticates, stores, and recycles cash for future use.

- Minimized Losses: Reduces shrinkage and counting errors through precise, secure processing.

- Increased Efficiency: Streamlines end-of-day closeouts and minimizes cash delivery requirements.

- Scalable Options: Available in various models to suit both high-volume operations and smaller setups.

At MVP, we don’t just offer the equipment. Whether it’s a smart safe for securing deposits or a TCR for complete cash recycling, we are your comprehensive partner for finding the right solution for your needs.

How to Get a Smart Safe

Selecting the right smart safe is more than just purchasing a machine–it’s about choosing the ideal tool for your business. Here’s what to consider:

Your Cash Volume

How much cash do you process each day? This helps determine the size and capacity of the safe you’ll need.

Integration Needs

Do you want your smart safe to connect with your point-of-sale system or ATM parts network? Integration can streamline your entire cash handling process.

Support and Service

Do you require installation, training, and ongoing maintenance? If something goes wrong, you’ll want fast, reliable service–ideally from certified ATM technicians or safe specialists.

Why Partner with MVP for Your Smart Safe Needs

When it comes to smart safes and cash handling, MVP offers more than just equipment–they deliver a custom-fit solution that works for your unique business.

Here’s what sets MVP apart:

- Full-Service Support: MVP goes above and beyond to find the smart safe ideal for your business. We offer installation, maintenance, and technical support for all your cash handling and TCR/ATM needs.

- ATM Expertise: With experience in ATM outsourcing, ATM parts, and ATM services, our team understands how to integrate smart safes into broader financial systems.

- Tailored Solutions: Every business is different. We will assess your needs and recommend the best smart safe configuration, whether you operate a single store or a multi-location chain.

Getting started is easy. Just reach out for a consultation. Our MVP team will seamlessly guide you through the process, from selection to setup.

A Big Opportunity for Local Institutions

Smart safes aren’t just for the big players. In fact, community-based institutions may be better positioned to offer these services in a way that’s more flexible, personal, and relevant to the local businesses they serve.

By combining smart safe technology with customized pricing, TCRs, and strategic vendor partnerships, MVP makes it easy to own, operate and/or offer the most updated financial equipment at your business.

Ready to take the next step?

Contact MVP today to explore how a smart safe program can elevate your institution’s business offerings and client relationships.