The start of a new year brings fresh opportunities to simplify operations, reduce costs, and make better business decisions. If you’re a financial institution or business owner planning to upgrade your financial equipment in 2026, it might be time to consider a more modern approach: bundled leasing.

Whether you’re exploring options like a TCR (Teller Cash Recycler), need to replace older ATMs, or are tired of juggling multiple service contracts, bundled leasing offers a convenient, cost-effective way to get the technology and support your business needs.

In this blog, we’ll walk you through what bundled leasing is, why it’s useful, and how MVP Financial Equipment can help you implement it with ease.

What Is Bundled Leasing?

Bundled leasing allows your business to lease essential financial equipment and services under one simple, monthly payment. It’s a smart alternative to traditional purchasing, especially if you want to avoid high upfront costs and complex vendor management.

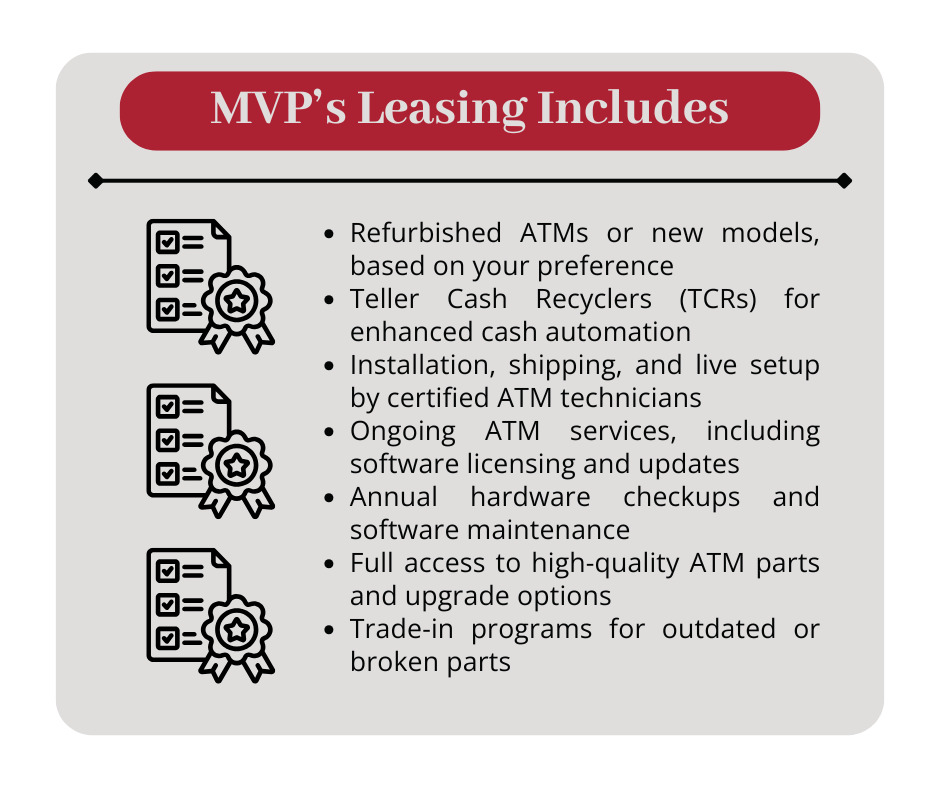

With MVP’s bundled leasing program, you can combine equipment, setup, and full ATM services into one customized solution. This includes:

- New or refurbished ATM units

- TCRs for efficient cash handling

- Shipping, installation, and go-live setup

- Annual software and hardware maintenance

- Support from trained ATM technicians

- Access to ATM parts replacement or trade-in

- Fixed monthly payment for easy budgeting

It’s an all-in-one solution that reduces stress, simplifies budgeting, and ensures your equipment stays operational year-round.

Why Bundled Leasing Works for Financial Institutions and Retailers

If you’re running a retail business or financial branch, you know how important it is to keep your cash-handling equipment working reliably. At the same time, managing multiple equipment vendors, service providers, and repair bills can quickly become overwhelming–not to mention expensive.

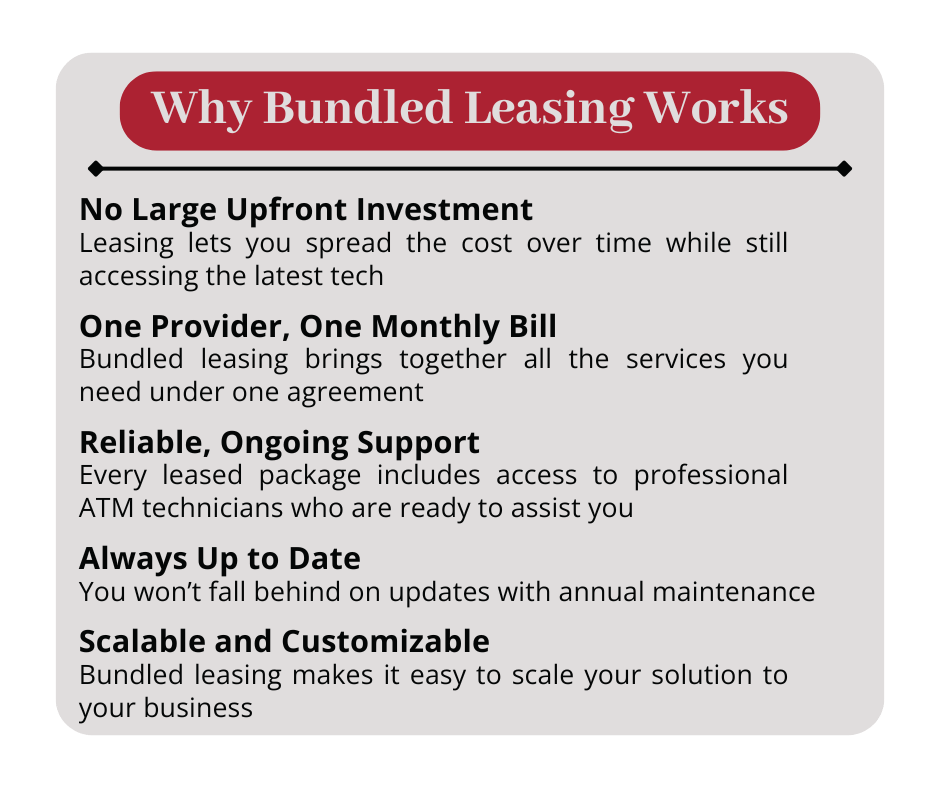

Here’s how bundled leasing can help:

No Large Upfront Investment

Purchasing a TCR or ATM outright can be expensive. Leasing lets you spread the cost over time while still accessing the latest tech. That’s ideal for businesses with flexible or seasonal cash flow.

One Provider, One Monthly Bill

Bundled leasing brings together all the services you need–ATM parts, maintenance, software, and installation–under one agreement. You’ll work with a single provider and pay a predictable monthly fee, making it easier to manage both expenses and responsibilities.

Reliable, Ongoing Support

Every leased package includes access to professional ATM technicians who are ready to assist with setup, repairs, or technical issues. MVP’s team is trained to support a wide range of financial equipment, ensuring you stay up and running.

Always Up to Date

With annual hardware and software maintenance built into your lease, you won’t fall behind on updates or risk downtime due to outdated systems. That’s peace of mind you won’t get from buying outright and handling updates yourself.

Scalable and Customizable

Need to add another refurbished ATM at a new location? Want to upgrade your TCR as your branch grows? Bundled leasing makes it easy to scale your solution to fit your business now and into the future.

Is Bundled Leasing the Right Fit for Your Business?

Bundled leasing is about choosing the right financial strategy for your operation. While it’s a strong fit for many organizations, it’s especially valuable if any of the following apply to your business.

You may benefit from bundled leasing if you:

-

Are using aging or unreliable ATM equipment that requires frequent repairs

-

Want to upgrade to a TCR but prefer to avoid a large upfront investment

-

Manage multiple locations and need consistent service across sites

-

Are tired of coordinating separate vendors for equipment, maintenance, and software

-

Prefer predictable monthly costs over surprise repair bills

-

Expect your cash-handling needs to change over the next few years

Bundled leasing is particularly well suited for banks, credit unions, retailers, and cash-intensive businesses that value uptime, operational simplicity, and long-term planning. If your goal is to modernize without overextending capital or internal resources, a bundled approach offers a clear advantage.

Why Choose MVP for Your Bundled Leasing Solution?

For over 25 years, MVP Financial Equipment has been a trusted provider for businesses across the financial services and retail industries. Here’s what makes us different:

Industry Experience

We’ve been working with banks, credit unions, and retailers since 2000. Our team understands the demands of the industry, and how to build solutions that work long-term.

Cost-Effective, Sustainable Options

Our refurbished ATM program offers a smart alternative to buying new. It’s budget-friendly and eco-conscious, reducing unnecessary tech waste.

Custom-Tailored Packages

We don’t do one-size-fits-all. Whether you need a single TCR or a full fleet of machines, we’ll create a plan that fits your business model and future goals.

Responsive, Expert Support

Our nationwide network of skilled ATM technicians is ready to respond quickly whenever you need help. We believe great service is just as important as great equipment

Make 2026 the Year You Simplify Your Equipment Strategy

If you’ve been putting off upgrading your systems because of high upfront costs or complexity, bundled leasing offers a refreshingly simple solution. From ATM parts and setup to ongoing ATM services, MVP makes it easy to modernize without the stress.

And what better time than the beginning of a new year? Whether you’re opening a new branch, expanding your retail operation, or just ready to upgrade outdated systems, MVP is here to help you start strong.

Let’s Take the Next Step Together

Ready to simplify your financial equipment strategy? Explore MVP’s Solutions Page to see how bundled leasing can work for your business, or schedule a free consultation with our team to build a customized package that fits your goals. Start 2026 with reliable equipment, expert support, and one predictable monthly payment.